The Majority of Veterans Are Unaware of a Key VA Loan Benefit

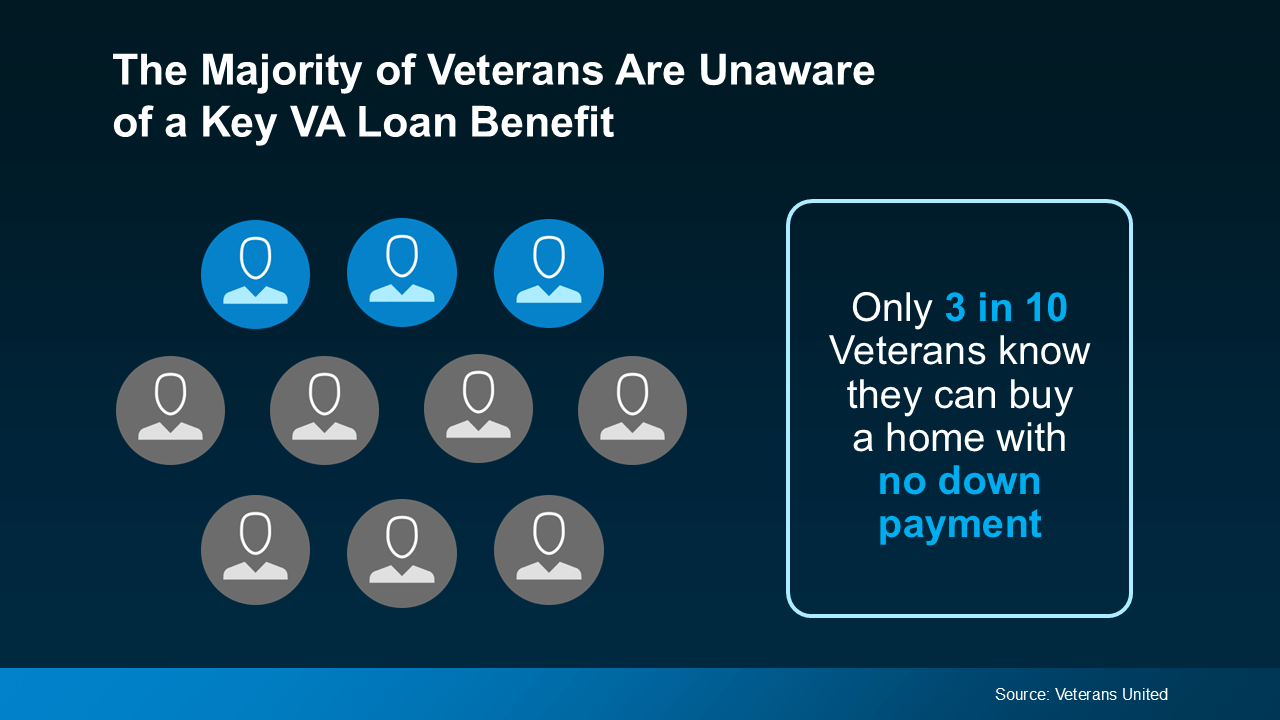

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment (see visual below):

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

“The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

VA home loans are designed to make homeownership a reality for those who have served our country. These loans come with the following benefits according to the Department of Veterans Affairs:

Your team of expert real estate professionals, including a local agent and a trusted lender, are the best resource to understand all the options and advantages available to help you achieve your homebuying goals.

Owning a home is a key part of the American Dream, and VA home loans are a powerful benefit for those who’ve served our country. Let’s connect to make sure you have everything you need to make confident decisions in the housing market.

Stay up to date on the latest real estate trends.

The San Francisco housing market closed out 2025 with impressive year-over-year gains in median sale prices. Single-family homes saw an 8.63% increase, with the median… Read more

As we moved through the holiday season, inventory levels dropped significantly across the East Bay.

The single-family home market is on fire in San Francisco right now, as the median sale price for a single-family home is reaching the highest level it’s reached in th… Read more

It’ll be important to pay attention to how this market evolves over the seasonally slow winter months, as dwindling inventories might drive prices up over time.

Last month we saw a big upward swing in median sale prices for single-family homes in San Francisco.

Listings are spending a lot more time on the market than they were last year, with single-family listings spending more than 20% longer on the market.

While much of the Bay Area is experiencing inventory issues, the vast majority of areas are seeing inventories begin to pile up. As we know, San Francisco has the oppo… Read more

Median sale prices in the East Bay have fallen for six months straight.

RSVP Below for Webinar Link | Join Us on 9/10 @ 5:30PM for a 1-Hour First-Time Homebuyer Webinar to Learn What it Takes to Buy a Home & More!

You’ve got questions and we can’t wait to answer them.