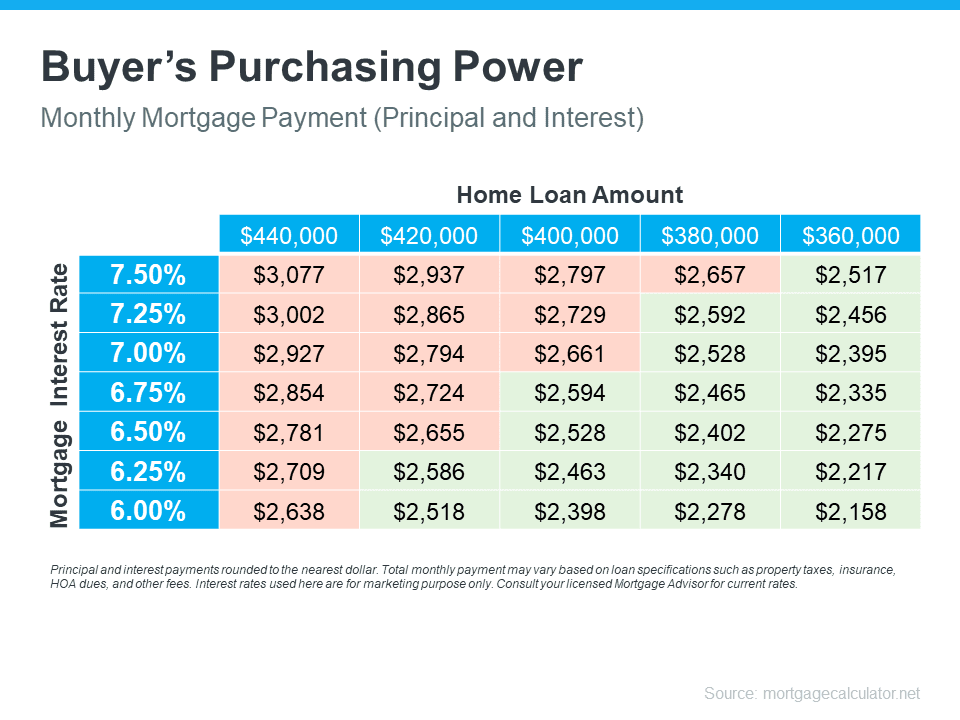

The Cost of Waiting for Mortgage Rates To Go Down

Stay up to date on the latest real estate trends.

While much of the Bay Area is experiencing inventory issues, the vast majority of areas are seeing inventories begin to pile up. As we know, San Francisco has the oppo… Read more

Median sale prices in the East Bay have fallen for six months straight.

RSVP Below for Webinar Link | Join Us on 9/10 @ 5:30PM for a 1-Hour First-Time Homebuyer Webinar to Learn What it Takes to Buy a Home & More!

Single-family home median sale prices rose by 4.42% on a year-over-year basis, while condo median sale prices rose by 10.52%. Additionally, the average single-family h… Read more

Single-family inventory levels are 20.05% higher on a year-over-year basis, and condo inventory levels are 13.15% higher.

Although many markets have seen a downtrend in pricing, San Francisco has remained incredibly resilient.

Although prices have been incredibly resilient in the East Bay, the future of this stability is very uncertain, as inventories have been growing at a tremendous rate.

Single-family homes continue to be a hot commodity, while condos continue to sit on the market.

Inventory levels are increasing drastically throughout the entire East Bay, with the area seeing over 40% more active listings than this time last year.

You’ve got questions and we can’t wait to answer them.