Have You Ever Seen a Housing Market Like This?

The year 2020 will certainly be one to remember, with new realities and norms that changed the way we live. This year’s real estate market is certainly no exception to that shift, with historic highlights continuing to break records and challenge what many thought possible in the housing market. Here’s a look at four key areas that are fundamentally defining the market this year.

The economy was intentionally put on pause this spring in response to the COVID-19 health crisis. Many aspects of the common real estate transaction were placed on hold at the same time. Thankfully, technology and innovation helped the industry power forward, and business gradually ramped back up as shelter-in-place orders were lifted.

The result? Total transformation of the market from rock-bottom lows to exceptional highs. Today, the housing recovery is being called truly remarkable by many experts and is far exceeding expectations. From pending home sales to purchase applications, buyers are back in business and homes are selling – fast.

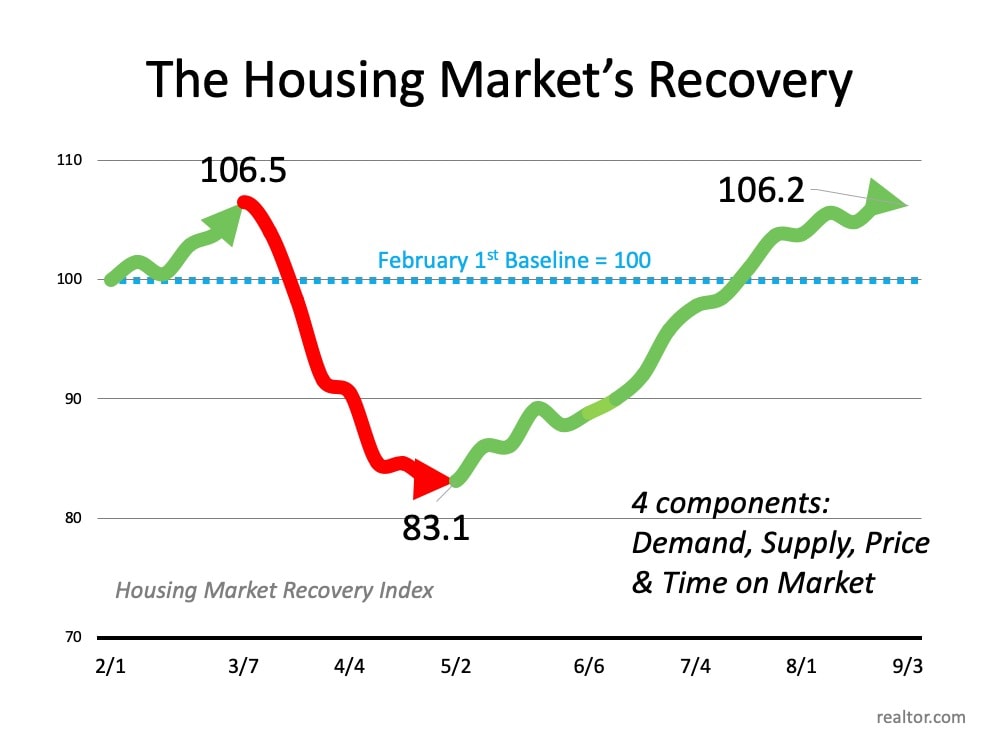

According to the Housing Market Recovery Index by realtor.com, the market has surpassed pre-pandemic levels, and has regained the strength we remember from February of this year (See graph below):

Historically low mortgage rates are another 2020 game-changer. Today’s low rate is one of the big motivating factors bringing buyers back into the market. The average rate reached an all-time low on multiple occasions this year, and it continues to hover in record-low territory.

When rates are this low, buyers have a huge opportunity to get more for their money when purchasing a home, something many are eager to find while continuing to spend more time than expected at home this year, and likely beyond.

One of the key drivers of home price appreciation this year is historically low inventory. Inventory was low going into the pandemic, and it is still sitting well below the level needed for a normal market. Although sellers are slowly making their way back into the game, buyers are scooping up homes faster than they’re coming up for sale.

This is a classic supply and demand scenario, forcing home prices to rise. Selling something when there is a higher demand for what is available naturally bumps up the price. If you’re ready to sell your house today, this may be the optimal time to make your move. As Bill Banfield, EVP of Capital Markets at Quicken Loans, notes:

“The pandemic has not stopped the consistent home price growth we have witnessed in recent years.”

Even as home prices continue to rise, affordability is working in favor of today’s homebuyers. According to many experts, rates this low are off-setting rising home prices, which increases buyer purchasing power – an opportunity not to be missed, especially if your family’s needs have changed. If you now need space for a home office, gym, virtual classroom, and more, it may be time to reconsider your current house.

According to Mortgage News Daily:

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

With mortgage rates hitting historic lows, home prices appreciating, affordability rising, and the market recovering like no other, 2020 has been quite a year for real estate – perhaps one we’ve never seen before and may never see again. Let’s connect today if you’re ready to take advantage of this year’s record-breaking opportunities.

Stay up to date on the latest real estate trends.

The single-family home market is on fire in San Francisco right now, as the median sale price for a single-family home is reaching the highest level it’s reached in th… Read more

It’ll be important to pay attention to how this market evolves over the seasonally slow winter months, as dwindling inventories might drive prices up over time.

Last month we saw a big upward swing in median sale prices for single-family homes in San Francisco.

Listings are spending a lot more time on the market than they were last year, with single-family listings spending more than 20% longer on the market.

While much of the Bay Area is experiencing inventory issues, the vast majority of areas are seeing inventories begin to pile up. As we know, San Francisco has the oppo… Read more

Median sale prices in the East Bay have fallen for six months straight.

RSVP Below for Webinar Link | Join Us on 9/10 @ 5:30PM for a 1-Hour First-Time Homebuyer Webinar to Learn What it Takes to Buy a Home & More!

Single-family home median sale prices rose by 4.42% on a year-over-year basis, while condo median sale prices rose by 10.52%. Additionally, the average single-family h… Read more

Single-family inventory levels are 20.05% higher on a year-over-year basis, and condo inventory levels are 13.15% higher.

You’ve got questions and we can’t wait to answer them.