Do Elections Impact the Housing Market?

The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market.

It’s a great question because buying or selling a home is a major decision, and it’s natural to wonder how such a major event might impact your plans.

Historically, Presidential elections have only had a small, temporary impact on the housing market. Here’s the latest on exactly what’s happened to home sales, prices, and mortgage rates throughout those time periods.

During the month of November, in years when the Presidential election takes place, there’s typically a slight slowdown in home sales. As Ali Wolf, Chief Economist at Zonda, explains:

“Usually, home sales are unchanged compared to a non-election year with the exception being November. In an election year, November is slower than normal.”

This is mostly because some people feel uncertain and hesitant about making big decisions during such a pivotal time. However, it’s important to know this slowdown is temporary. Historically, home sales bounce back in December and continue to rise the following year.

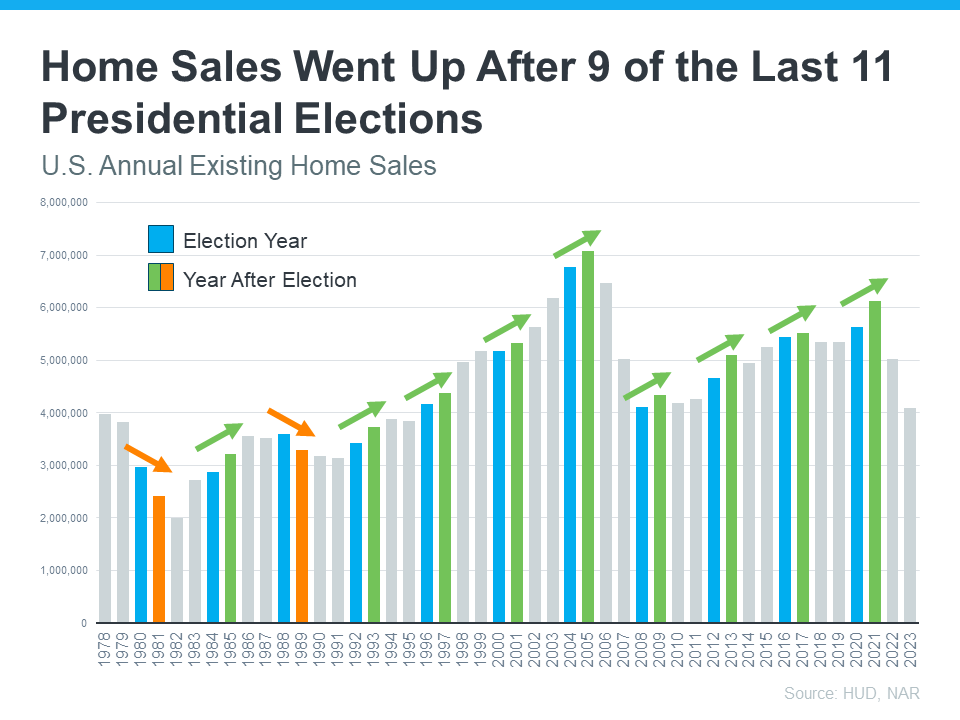

In fact, data from the Department of Housing and Urban Development (HUD) and the National Association of Realtors (NAR) shows after nine of the last 11 Presidential elections, home sales went up the next year (see graph below):

The graph shows annual home sales going back to 1978. Each year with a Presidential election is noted in blue. The year immediately after each election is green if existing home sales rose that year. The two orange bars represent the only years when home sales decreased after an election.

What about home prices? Do they drop during election years? Not typically. As residential appraiser and housing analyst Ryan Lundquist puts it:

“An election year doesn’t alter the price trend that is already happening in the market.”

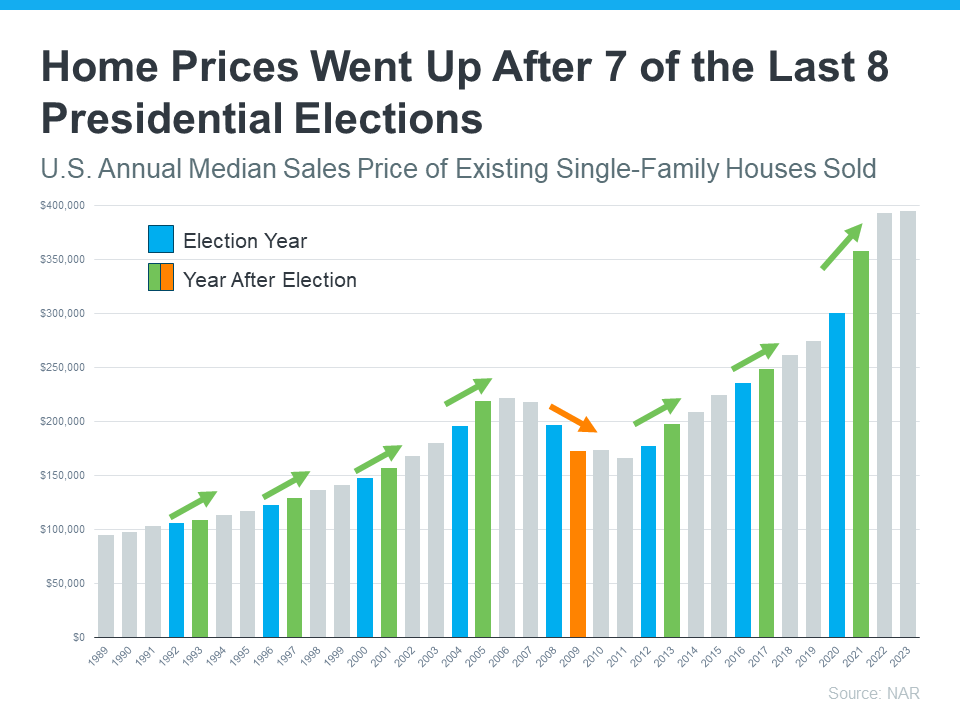

Home prices are pretty resilient. They generally rise year-over-year, regardless of elections. The latest data from NAR shows after seven of the last eight Presidential elections, home prices increased the following year (see graph below):

Just like the previous graph, this shows election years in blue. The only year when prices declined after an election is in orange. That was during the housing market crash, which was far from a typical year. Today’s market is different than it was back then.

All the green bars represent when prices rose the following year. So, if you're worried about your home losing value because of an election, you can rest easy knowing prices rise after most Presidential elections.

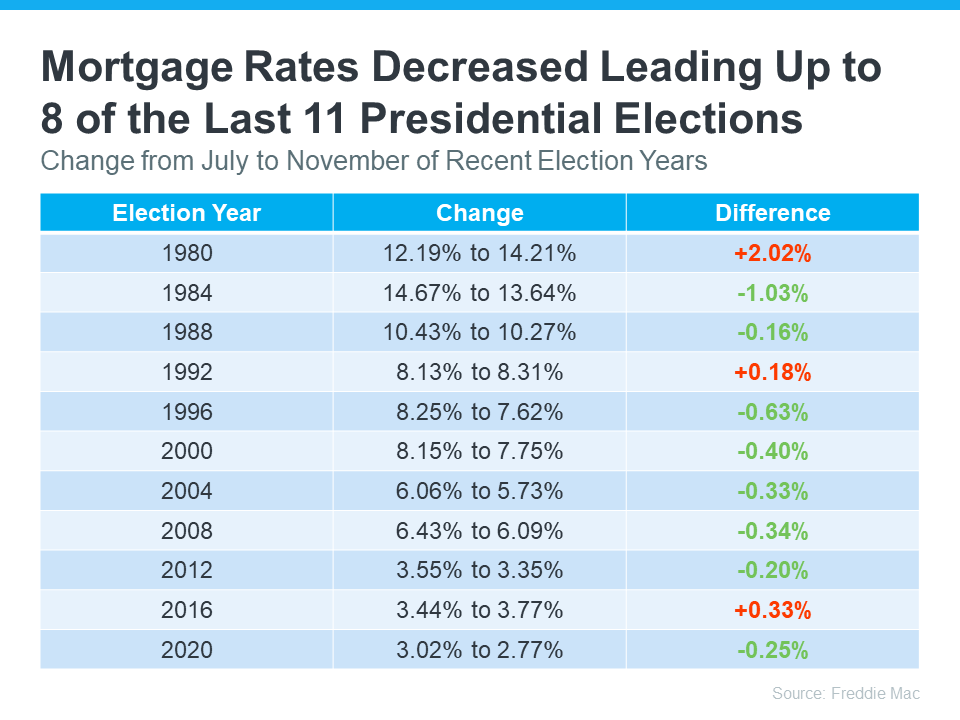

Mortgage rates are important because they affect how much your monthly payment will be when you buy a home. Looking at the last 11 Presidential election years, data from Freddie Mac shows mortgage rates decreased from July to November in eight of them (see chart below):

Most forecasts expect mortgage rates to ease slightly throughout the remainder of the year. If they’re right, this year will follow the trend of declining rates leading up to most previous elections. And if you’re looking to buy a home in the coming months, this could be good news, as lower rates could mean a lower monthly payment.

So, what’s the big takeaway? While Presidential elections do have some impact on the housing market, the effects are usually small and temporary. As Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.”

For most buyers and sellers, elections don’t have a major impact on their plans.

While it’s natural to feel a bit uncertain during an election year, history shows the housing market remains strong and resilient. For help navigating the market, election year or not, let’s connect.

Stay up to date on the latest real estate trends.

The San Francisco housing market closed out 2025 with impressive year-over-year gains in median sale prices. Single-family homes saw an 8.63% increase, with the median… Read more

As we moved through the holiday season, inventory levels dropped significantly across the East Bay.

The single-family home market is on fire in San Francisco right now, as the median sale price for a single-family home is reaching the highest level it’s reached in th… Read more

It’ll be important to pay attention to how this market evolves over the seasonally slow winter months, as dwindling inventories might drive prices up over time.

Last month we saw a big upward swing in median sale prices for single-family homes in San Francisco.

Listings are spending a lot more time on the market than they were last year, with single-family listings spending more than 20% longer on the market.

While much of the Bay Area is experiencing inventory issues, the vast majority of areas are seeing inventories begin to pile up. As we know, San Francisco has the oppo… Read more

Median sale prices in the East Bay have fallen for six months straight.

RSVP Below for Webinar Link | Join Us on 9/10 @ 5:30PM for a 1-Hour First-Time Homebuyer Webinar to Learn What it Takes to Buy a Home & More!

You’ve got questions and we can’t wait to answer them.